Note: This comprehensive article is a long read, but we think it is worth it!

The latest generation of prescription drugs developed to help people manage Type 2 diabetes has been causing quite a stir for patients, health professionals, and benefit plans alike. In addition to their intended use in treating Type 2 diabetes, several GLP-1 drugs are also FDA-approved for weight loss, while others are being used for weight loss on an off-label basis.

As generally happens with innovative therapies, both health plan sponsors and insurance carriers face challenges in creating guidelines for coverage of the drugs. The majority of employers and insurance carrier plans currently exclude weight loss drugs from coverage; however, a small but increasing number of employers are jumping on board to offer coverage for this new class of medications.

Experts agree that the GLP-1 craze we are witnessing in both the general population and the pharmaceutical industry is not a short-term, acute phenomenon. Rather, it is expected to be a long-term issue that will continue to drive discussion, spark development, and impact health plan costs in the decade ahead.

A Roadmap to Understanding

Much has been written about GLP-1s and their impact on employer health plans. The intention of this article is to dispel the fog of information and synthesize key concepts employers need to know...essentially, to provide an easy roadmap to understanding this complex topic. In this article, we will address the following issues:

GLP-1s Made Easy

Marketplace and Drug Pipeline

Obesity – The Reality of the Need

Insurance Coverage Realities

The Wrong Question and the Right Question

Cost and Healthcare Spending

Prior Authorization Realities

Final Thoughts

GLP-1s Made Easy

What are the Drugs?

GLP-1 (Glucagon-Like Peptide-1) is a hormone that plays a crucial role in regulating blood sugar levels. As such, the category of drugs that target that hormone are also used to treat Type 2 diabetes. These drugs are known as GLP-1 agonists. That class of medications was the first to be FDA-approved for the treatment of Type 2 diabetes because of their effectiveness in regulating blood sugar in the body.

When GLP-1s were first developed, manufacturers intended for the drugs to be narrowly prescribed for those with Type 2 diabetes. However, after these medications were introduced, patients started to experience the unexpected side effect of weight loss. At that point, manufacturers dove into the underlying science behind the drugs and recognized the significant potential of these drugs as highly effective stand-alone weight loss medications to treat obesity.

In English . . .what do the drugs do?

GLP-1 medications increase insulin release, delay digestion, and decrease appetite.

- For diabetics, they help regulate insulin AND help prevent cardiovascular disease.

- For obese patients, they can help reduce body weight by an average of 15% (in conjunction with lifestyle changes such as diet and exercise).

It is important to note that the drugs are effective at weight loss only in the context of other behavioral changes, such as attention to diet and exercise. Without these underlying lifestyle changes, weight loss is unlikely to be permanent in the future.

Research Findings

Multiple clinical trials have demonstrated weight loss between 15%-20% of body weight compared to a placebo at 3-4%. One of the most extreme clinical trials resulted in an average weight loss of 52 pounds (22.5%). Essentially, all drug manufacturers are engaging in continued clinical trials to confirm the efficacy and unique value of their GLP-1 formulations.

Importantly, research has also shown that upon discontinuing the medication, much, if not all, of the weight is regained. This is an important consideration for balancing the health and life benefits of GLP-1 medications with the long-term cost of the treatment.

What are the drug names?

Many GLP-1 drug names have already become widely known because of broad direct-to-consumer advertising. There are currently nine GLP-1 medications approved for the treatment of diabetes and/or weight loss. The following chart (courtesy of CVS Health) provides an overview of the most popular brand names and their FDA approval status.

|

Medication

|

FDA Approval Status

|

Patients

|

|

Ozempic®

|

Type 2 diabetes

|

Adults

|

|

Rybelsus®

|

Type 2 diabetes

|

Adults

|

|

Byetta®

|

Type 2 diabetes

|

Adults

|

|

Mounjaro®

|

Type 2 diabetes

|

Adults

|

|

Victoza®

|

Type 2 diabetes

|

Children (age 12+)

|

|

Trulicity®

|

Type 2 diabetes

|

Children (age 12+)

|

|

Wegovy®

|

Weight management

|

Adults and Children (age 12+)

|

|

Saxenda®

|

Weight management

|

Adults and Children (age 12+)

|

|

Zepbound™

|

Weight management

|

Adults

|

Marketplace and Drug Pipeline

The GLP-1 Pipeline

Pundits believe that we are at the very beginning of a GLP-1 wave. The exceptionally large potential target population for GLP-1 drugs and the known efficacy of the drug mechanisms, virtually guarantee further investment by pharmaceutical manufacturers. The biggest indicator of this is the current drug development pipeline. Pharmaceutical manufacturers are investing heavily in the development of new and novel indications of GLP-1 drugs, as well as GLPs that apply to more than one receptor.

Manufacturers are also working to develop new (and more patient-friendly) ways to administer the medications. Currently, all GLP-1s (except Rybelsus®) are administered by injections (once weekly or daily). Needle-phobia is real, and most patients do not like injected drugs. This reality has pharmaceutical manufacturers racing to develop new ways to administer the medications. There are currently a few pipeline products that are monthly injections that would further reduce that administration burden and provide a more convenient treatment option for patients.

Lastly, drug manufacturers are also studying the use of GLP-1s for the treatment of cardiovascular disease, as well as several other diseases that are often co-morbidities with diabetes (including heart failure, peripheral arterial disease, sleep apnea, and diabetic retinopathy).

Growth By Advertising and Social Media Influencers

The unique efficacy of the drugs is not the only reason for their rapid growth. Drug manufacturers have poured hundreds of millions of dollars into highly effective ad campaigns. In addition, many high-impact influencers with star-power names have shared their weight-loss “secret.” This has expanded reach and normalized taking GLP-1s for weight loss (absent a diabetes diagnosis). These forces have combined to create an interesting market dynamic with substantial demand for GLP-1 medications for weight loss purposes.

|

GLP-1 Market Size

|

|

2022

|

$22B

|

|

10-Year Prediction (2032)

|

$72B

|

Obesity: The Reality of the Need

The Unspoken Debate: Chronic Disease vs. Lifestyle Disease

It is important to recognize the unspoken debate that is unfolding over GLP-1s. Diabetes is an industry-accepted chronic disease that, if left untreated, can result in not only disease progression (which is costly) but additional medical complications and exacerbation of underlying co-morbidities. These, in turn, can be even more costly.

On the other hand, obesity has historically been labeled as a lifestyle disease. Because of this, many plan sponsors have not and do not cover weight loss drugs under the pharmacy benefit, as the perception was it did not address a medical need. That said, in the wake of the GLP-1 craze, employers are being forced to re-evaluate their coverage for these popular weight loss drugs. The steep price tag of GLP-1s has created a complex web of financial and human consequences for employers to consider. At the center of this reality is the understanding of obesity as a health crisis in the United States.

Obesity as a Health Crisis: Current State

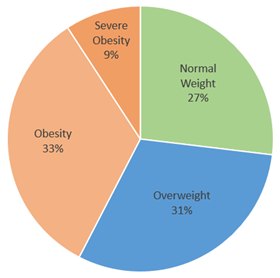

Neither the prevalence of obesity nor the impact of co-morbidities associated with obesity in our society can be ignored. Following are some current statistics relating to obesity in the United States

- 42% prevalence of obesity in U.S., 2017-2020 (www.cdc.com)

- 200+ diseases are associated with obesity (medicaleconomics.com)

- 73.1% of the population is overweight or obese

|

Category

|

BMI

|

Percentage of Adults

|

|

Normal Weight

|

18.5 to 24.9

|

26.9%

|

|

Overweight

|

25 to 29.9

|

30.7%

|

|

Obesity

|

30+

|

33.2%

|

|

Severe Obesity

|

40+

|

9.2%

|

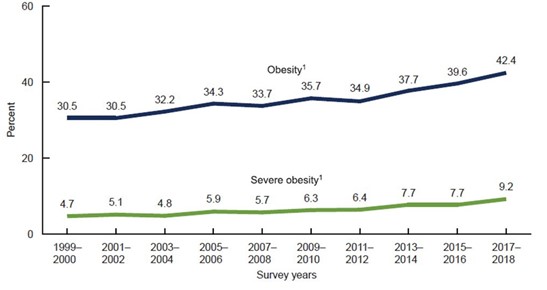

Future Projections of Obesity Prevalence

Unfortunately, trends are not in our favor for either obesity or diabetes prevalence.

- 1 in 2 adults will be obese by 2030 (www.nejm.com)

- 1 in 4 adults will be severely obese by 2030 (www.nejm.com)

- Prevalence of diabetes (Type 1 and Type 2) will increase by 54% from 35M people in 2015 to 54M people in 2030 (www.nih.gov)

- Growth in percentage of population with obesity and severe obesity from 1999-2018:

On the Positive Side

The American Medical Association has recognized obesity as a “chronic disease” because it can be the underlying cause of other medical conditions, such as heart disease, diabetes, and even some cancers. Obesity can even shorten life expectancy by up to eight years and cut healthy life by up to 19 years. As a result, there is a growing argument to be made that providing coverage under group health plans to address obesity may be medically necessary and appropriate...and potentially cost-efficient (to the extent that the cost to treat other co-morbidities would be curtailed by the reduction in the underlying co-morbidity/cause of obesity). These factors will likely also play into insurance coverage decisions by employers and insurance carriers.

Insurance Coverage Realities

Coverage for Diabetes

As a rule, most health plans have at least one GLP-1 medication on their formulary for the treatment of diabetes. The remainder of this discussion will focus on coverage for GLP-1s for weight loss without a diabetes diagnosis.

Are GLP-1s covered by insurance plans?

The web of insurance coverage (and non-coverage) for GLP-1 medications for weight loss is complicated. Social sources of coverage are inconsistent (based on state and program) and employer-sponsored insurance plans have inconsistent coverage rules. Some, but not all, employers are in a position to choose whether they elect to cover weight loss medications, including GLP-1s.

|

Health Plan Type

|

Coverage Notes

|

|

Medicaid

|

Coverage for drugs prescribed for weight loss varies by state but is limited for GLP-1 drugs.

|

|

Medicare

|

No coverage.

|

|

Employer-Based Coverage – Self-Funded Plans

|

Employers with self-funded plans can usually choose whether to cover GLP-1s for weight management.

|

|

Employer-Based Coverage – Fully Insured Plans

|

Employers with fully insured health plans “inherit” the plan coverage decisions of their insurance carriers . . . and, in some cases, the insurance coverage mandates of their state.

|

|

Individual Policies

|

Today, most states combine individual coverage with small employer coverage mandates. Thus, coverage mandates in the fully insured marketplace will typically cascade to individual policies as well.

|

Medi-Cal Coverage in California

Historically, California Medicaid (referred to as Medi-Cal) has provided coverage for GLP-1s for the treatment of diabetes. Coverage of medications for obesity has historically been excluded. However, in the latest Medi-Cal Rx Contract Drug List (updated December 1, 2023), Saxenda® and Wegovy® are included as treatments for obesity.

Employer-Sponsored Coverage

In 2024, there is no mandate to cover GLP-1s for weight loss in California. As a result, employers and participants alike will continue to experience a patchwork of coverage depending on employer or carrier determinations (as outlined above).

California Obesity Treatment Parity Act

A bill known as the Obesity Treatment Parity Act (SB 839) has been introduced in the California legislature. The bill would mandate comprehensive coverage for the treatment of obesity, including coverage for intensive behavioral therapy, bariatric surgery, and FDA-approved anti-obesity medication (including GLP-1s).

The bill would require policies to provide coverage in the same manner as any other illness, condition, or disorder relative to deductibles, copayments, coinsurance, and out-of-pocket maximums. The whole of the law uses a mere 189 words to amend the CA Health and Safety Code and the Insurance Code to create full parity for the treatment of obesity with any other medical condition.

This will be a closely watched bill as it moves through the legislature in the coming session. If some form of the bill becomes law, employers will need to carefully consider and plan for expected health plan cost increases. Remember, however, if the law is passed, as a state law, the coverage mandate would only apply to fully insured plans, not self-funded plans.

Fully Insured Plans: Employers Don’t Get a Vote

Here, it is relevant to understand the current marketplace for 2024. Please note some contracts may deviate from the standard provisions, and these contradicting provisions are a moving target. Market segment plays a part in determining potential coverage parameters.

- Small Groups (<100 lives): The small group market is the most restrictive, as carriers have a library of pre-defined plans from which employers may choose.

- Mid-Market Groups (100 to 300 lives): The mid-market segment will typically mirror the small group marketplace with pre-defined plans.

- Large Groups (300+ lives): The large, fully insured employer marketplace will offer the most flexibility as employers have more say in plan design parameters in this market segment. Carriers are starting to address the actuarial assumptions and rate impact of these offerings. We have seen a wide range of potential rate impacts in the quoting process, from 0.5% to 3.0%.

Self-Funded Plans: To Cover or Not to Cover...That Is the Question

The decision of whether or not to cover GLP-1s for weight loss is important for plan sponsors, as the significant increase in utilization of GLP-1s for weight loss will place a substantial financial burden on employers. There is also the complex intertwined cost reality that, while there will be an obvious increase in cost when covering GLP-1s, plan sponsors also need to consider the potential longer-term benefits for members’ improved health, such as the avoidance of disease complications related to obesity.

It is difficult to find reliable information on how many employers cover GLP-1s for weight loss at this time. What we do know is that while the drugs have surged in popularity over the past year, coverage for the drugs has not tracked that popularity. The best survey numbers seem to show that very large employers remain split, with the number providing coverage hovering at less than half (46%). Smaller employer plans are less likely to cover the medications. A significant number of employers indicated they are considering whether to add the coverage in the future, citing cost as the major consideration. Expect continued discussions among self-funded employers about the pros and cons of adding GLP-1 coverage for weight management.

Taking the Temperature of Employers

The high immediate costs to health plans as well as the potential for sustained increases in healthcare spend over the long term (assuming employees will stay on the drug for longer periods) are cited as reasons for more employers wading slowly into the GLP-1 waters. That said, GLP-1s are not going away, nor will the decisions employers need to make regarding how they balance the high cost with health benefits and employee relations considerations.

The Wrong Question and the Right Question

A Common Question

Employers and employees alike are asking the question, “Are GLP-1s covered?” It seems like a reasonable question, however, it’s a question that often begs an incorrect answer . . . or at least not an answer to the specific question that the inquirer truly intended.

The Wrong Question

“Are GLP-1s covered under our plan?” is the wrong question to ask. It’s the wrong question because most plans will answer, “Yes, but coverage may be only available in limited circumstances.” For example, most plans today do cover GLP-1s when a diabetes diagnosis exists. However, typically when the question is asked today, the intention is to clarify if GLP-1s are covered for weight loss . . . and that is an entirely different question.

What’s the right question?

The right question to ask is actually two questions.

Question #1: Are GLP-1s covered for weight loss without a diabetes diagnosis?

Question #2: What are the criteria for covering GLP-1s for weight loss?

How do I figure out GLP-1 coverage details?

Vita maintains a Resource Guide for coverage and pre-authorization requirements for the major carriers for fully insured plans. It is important to note that each carrier has established detailed criteria for how they cover GLP-1s for weight loss. In addition, coverage and criteria differ between small-group and large-group plans. Vita has consolidated summary information for easy reference as well. For detailed information on coverage standards through your carrier, complete this form to request a consultation or reach out to your Vita Account Manager.

Cost and Healthcare Spending

What is the cost?

The reality is that GLP-1 drugs, as a class, are very expensive. This is partially because of their efficacy and the increasing demand for the medications. However, it is also important to recognize that there are no generics available for GLP-1 medications. It is unlikely that substantial generics will be available until well into the 2030s when initial patent protections expire.

Much has been written about the cost of GLP-1s and the potential healthcare spending increase for employers and health plans if widespread coverage and utilization were to be adopted. For this article, we will simply outline the raw retail costs and some basic realities about rebates, which can reduce the cost for some plan sponsors.

Consider the following:

- The cost for GLP-1 treatment is between $700 - $1,400 per month (retail cost).

- Expert analyses have projected that weight loss drugs have the potential to increase health costs up to $300 per employee per month, depending on how widely coverage is offered and the overall percentage of overweight and obese participants who elect to seek treatment.

Following is a summary of the retail and typical pharmacy prices for GLP-1 drugs. For those who have heard they are “expensive” but haven’t seen the real numbers, this is often a “Wow” moment.

|

Medication

|

Typical Pharmacy Price

|

Retail Price

|

Gross Annual Cost*

|

|

Ozempic®

|

$916

|

$1,224

|

$11,000

|

|

Rybelsus®

|

$890

|

$935

|

$11,000

|

|

Byetta®

|

$784

|

$978

|

$9,000

|

|

Mounjaro®

|

$1,000

|

$1,228

|

$12,000

|

|

Victoza®

|

$1,153

|

$1,345

|

$14,000

|

|

Trulicity®

|

$812

|

$1,096

|

$10,000

|

|

Wegovy®

|

$1,391

|

$1,590

|

$17,000

|

|

Saxenda®

|

$1,280

|

$1,279

|

$15,000

|

|

Zepbound™

|

$1,007

|

$1,279

|

$12,000

|

*Gross annual cost reflects a rounded calculation of 12x the typical pharmacy cost. It does not take into account drug rebates for employers/carriers or discount coupons for participants.

What about rebates?

Rebates have a large impact and are an important element of the total cost for GLP-1 drugs. While the details of rebate contracts are very closely guarded by Pharmacy Benefit Managers (PBMs), it is generally accepted that rebates for GLP-1 drugs are in the 40%-50% range (based on retail pricing). Notably, this is another area where the experience of self-funded and fully insured employers will differ:

-

Fully Insured Employers: Rebates will be paid to the insurance carrier (employers will not directly participate). While it is said that insurance carriers will use the rebates to offset overall fully insured premiums, the lack of transparency around these rebates is concerning to many employers.

-

Self-Funded Employers: Rebates are typically passed through (at least in some measure) to self-funded employers. Therefore, self-funded plans will have the potential of direct cost impacts due to rebates (albeit delayed as rebates are paid in arrears).

What about drug coupons?

Essentially, all manufacturers have coupon offers that make the drugs significantly more affordable for plan participants. These coupons effectively waive or limit what would otherwise be high participant cost sharing for these medications. Manufacturers and PBMs arrange to accept a lesser copay or coinsurance amount from plan participants but “make it up” on the plan payment side where drug costs are not discounted. Traditionally, drug coupon programs are means-tested and reserved for those with limited income. However, with the potential dollars on the table for GLP-1 drug manufacturers, it may be that we see fewer such restrictions in the future.

There has been significant regulatory back and forth about whether the value of drug coupons should be counted toward the deductible and out-of-pocket expenses. Regulatory guidance has recently been clarified that the value of such coupons (which can be substantial) does NOT count toward a participant’s deductible and out-of-pocket expenses. The deductible and out-of-pocket expenses must be met by the participant paying in “real” dollars, not in coupon-equivalent dollars.

Manufacturer Direct-to-Consumer Model

Due to the tremendous potential market size, Lilly (the manufacturer of Zepbound™) has created a direct-to-consumer channel whereby individuals can obtain GLP-1 drugs while bypassing the traditional insurance plan and pharmacy channel. This new option combines a "convenience play" with a substantial direct discount if insurance is not available. The strategy aims to monetize direct consumer payments as full payment with the goal of lowering the “barrier to entry” and thus increasing sales volume.

There are also other companies and weight loss centers popping up as “Wellness Companies” that are promoting "compounded" versions of the active ingredients in GLP-1s. These are available at a reduced price, but consumers should beware that compound medications are not approved by the FDA or guaranteed.

Cost is THE Thing

Employers and insurance carriers everywhere are looking carefully at the issues of cost and efficacy. Essentially all stakeholders are working to understand the complex issues and to create a strategy around the cost of offering GLP-1 coverage for weight loss.

Prior Authorization Realities

Can everyone get the drug?

No. There is significant treatment alignment and cost-containment measures applied to GLP-1 medications for weight management. When GLP-1s are covered for obesity, the goal is to ensure that the medication is authorized only for those who meet the specific criteria. This assures both optimal clinical effectiveness for the patient and appropriate cost containment for plans.

Cost Containment Measures

Pharmacy Benefit Managers can and do apply the standard three cost containment “tools” to GLP-1s. These standard tools have varying degrees of effectiveness in containing costs based on the diagnosis and how the programs are structured.

Quantity Limits: This typically ensures that the supply prescribed does not exceed the FDA-approved label of the drug. It confirms that prescribers and patients aren’t using the drug at higher dosages than the indication calls for. In general, this isn’t likely to be a big cost-saver for employers. That said, it is reasonable to understand that typical quantity limits for GLP-1 medications range from 16-28 weeks for the initial prescription, with subsequent limits at 6-month intervals.

Step Therapy: In standard step therapy programs, patients are required to try one or more therapies prior to stepping up to a more expensive therapy. In the case of a diabetic patient, Metformin has been the standard first line of defense medication for decades. Initially, plans required patients to “step through” the less expensive Metformin treatment before taking GLP-1s; however, due to updated diabetes treatment guidelines, GLP-1s are being used earlier in diabetes treatment progression today. With regard to obesity, there are several other weight loss medications that could be used in a step therapy requirement prior to using GLP-1s. However, the other medications have not been shown to provide the level of weight reduction that the GLP-1s have. Thus, whether step therapy programs are required for an obesity diagnosis (providing the plan provides coverage for weight management drugs) is very plan-specific.

Prior Authorization: This is “the big thing” for GLP-1 therapy management. As such, it is addressed in more detail below.

Prior Authorization: Defining the Hoops to Jump Through

Plan sponsors, PBMs, and insurance carriers alike require a stringent pre-authorization process to qualify for GLP-1 treatment for weight loss. As an important point of distinction, across the board, pre-authorization (while still required under many plans) is becoming much more streamlined for plan participants with a diabetes diagnosis.

Plans can take various approaches to who they define as eligible and, thus, how the pre-authorization process is defined. The following outlines a progression of criteria that might be applied by a plan as part of the prior authorization process, in order from more lax to more strict.

-

No Criteria: The plan contains no specific criteria for a non-diabetic individual to receive a GLP-1. (This option is rarely utilized.)

-

BMI Only: The plan requires medical documentation of a BMI exceeding a specific threshold, typically greater than 30.

-

BMI + Co-Morbidity: The plan requires medical documentation of a BMI exceeding a specific threshold (often greater than 27) AND medical documentation of a co-morbidity that is related to obesity. Examples include high blood pressure, dyslipidemia, heart disease, sleep apnea, cardiovascular disease, etc.

-

BMI + 2 Co-Morbidities: As above, only the plan requires at least two co-morbidities related to obesity.

-

BMI + Co-Morbidities + Lifestyle Modification: As above, only the plan requires proof of a diet plan and exercise regime (sustained for some period of time, typically six months).

-

BMI + Lifestyle Modification Failure: The plan requires medical documentation of a BMI exceeding a specific threshold, typically greater than 30, AND medical documentation that lifestyle modification measures (diet and exercise) have been attempted for at least six months with no measurable results.

-

BMI + Co-Morbidity + Lifestyle Modifications: As above, with a commitment that the participant will pair the drugs with lifestyle modifications.

-

BMI + Co-Morbidity + Structured Weight Management Program: As above, with ongoing participation in an employer-sponsored weight management program. In some cases, employers are working with specialty vendors to provide structured programs that include resources such as behavior coaching, nutrition counseling, and exercise plan development.

There are usually specific variations of the adult criteria that apply to children (ages 12-18).

Re-Authorization

Due to the high cost and extended treatment duration for GLP-1 therapies, PBMs are starting to apply a “re-authorization” process. This procedure is intended to confirm that the participant is experiencing a positive impact from the GLP-1 therapy, still meets the pre-authorization criteria, and is still actively pairing the drug treatment with lifestyle modifications as required. The re-authorization process is typically scheduled on a six-month cadence.

Higher BMI Requirement

Some employers see the benefit of adding coverage for GLP-1s for weight management but are concerned about the reality of the potential plan cost increase. To offer the benefit but better manage the cost, employers may increase the requisite BMI to 35 or higher, thus providing the benefit, but restricting availability (and cost exposure) to those with more severe obesity (and thus greater potential impact).

Lifestyle Coaching Programs as Gatekeepers for GLP-1s

When used as a treatment for obesity, GLP-1s are designed to be used in conjunction with diet and exercise behavior modifications. Essentially, all pre-authorization programs require at least concurrent commitment to lifestyle modifications, and many require 3-6 months of diet and exercise modification prior to gaining access to the medications.

Structured Programs: Many employers are considering providing additional support tools and programs for employees with obesity. In most cases, this comes in the form of partnering with an outsourced specialty vendor that provides structured virtual programs that include such resources as behavior coaching, nutrition counseling, and exercise plan development. In some cases, employers use active participation in these programs as a criterion for pre-authorization (thus taking some of the guesswork out of whether an employee is actively participating in the necessary lifestyle changes to support successful GLP-1 treatment).

The Challenge: The challenge comes in how such efforts are to be measured. Is self-attestation enough? Should they be measured by weight loss results over time? Is an improvement in biometrics relating to a co-morbidity (such as cholesterol or high blood pressure) sufficient? Or is active participation in a formal program of some sort required? Employers and PBMs alike are grappling with the questions of how to gauge satisfactory commitment to behavior modifications and what is considered an acceptable improvement as a result of such efforts in order to gain access or maintain access to GLP-1s.

A New Trend: Enter a new product in the marketplace. There is a new trend developing where employers are looking toward formal virtual lifestyle coaching or weight management programs to assist in managing access to GLP-1s for weight loss. Formal virtual lifestyle coaching programs are being developed, specifically to fill the role of both supporting employees in their behavior modification efforts and being the gatekeeper to the expensive GLP-1 medications. From the employer’s perspective, it takes some of the guesswork out of the process. An employer would sponsor the program and then plan participants interested in taking GLP-1s for weight loss would engage with the weight management program that involves diet and exercise for six months before they can get a GLP-1.

Ongoing Gatekeeping: The programs then also manage participants, ensuring they meet ongoing diet and exercise requirements to continue being prescribed the drugs.

Cost Issues: It is also important to recognize two cost impacts of this strategy. First, when access to GLP-1 medications for weight loss is “pushed off” for six months while behavior modifications are being kicked off, the plan is not incurring the monthly cost for the medications. Second, we must recognize that some participants will not “pass the test” and thus not get access to the expensive medications. This will both save employer claims dollars and focus the expenditures where there is a higher potential for success. Lastly, formal weight management or coaching programs are much less expensive than the cost of the GLP-1 drugs, so such a strategy can be seen as cost-effective.

The Goal: By using formal lifestyle and weight loss programs, employers are provided more assurance that the cost of the drug would be an investment worth making. Formal monitoring of the concomitant lifestyle modification requirements would provide plan oversight, and participants would have important support in making lifestyle modifications more possible.

Pre-Authorization Criteria Summary

As a rule, plans that cover GLP-1 medications for weight loss typically require some variation of the following three criteria to be met:

-

Participants qualify as obese (based on specific BMI measurements)

-

Participants have at least one additional, related health condition

-

Participants commit to pairing the drug treatment with the necessary lifestyle/behavior changes as a condition of receiving the medication. In some cases, structured weight management program participation may be required (including behavior management coaching and nutrition counseling).

As a reminder, the intention of the pre-authorization process is to balance cost and access to the treatment, specifically to reserve the treatment (and cost expenditure) for those who have met the criteria for a potentially positive outcome.

Final Thoughts

Conclusion

The landscape of GLP-1s for weight management is evolving rapidly. Employers will be called upon in the years to come to consider their approach to managing obesity, both from a pharmacy benefit perspective and from an overall population wellness perspective.

Plan design choices for smaller fully insured employers will be constrained by insurance carrier decisions. However, if a state coverage mandate passes, the costs for weight management drugs will be required to be borne by all.

Plan design decisions for larger, self-funded employers are a current decision point. Careful consideration should be given to projected costs and potential health and wellness benefits for the employee population.

Overall, employers should keep their ears to the ground on this issue. Tackling the obesity epidemic will not be a short-term endeavor, nor will it happen without significant cost and social change. That said, today’s employers and HR professionals are on the “ground floor” as critical decisions are made in how we address healthcare coverage and costs of treatments for obesity. Stay tuned!

References

California Obesity Treatment Parity Act

National Institutes of Health Overweight and Obesity Statistics

Diabetes 2030: Insights from Yesterday, Today, and Future Trends

Projected U.S. State-Level Prevalence of Adult Obesity and Severe Obesity