The Medicare secondary payer rules determine when your group health plan must pay primary and when it can pay secondary to Medicare (a.k.a. Coordination of Benefits). Unfortunately, these rules are lengthy and complex. Payment order depends on employer size and reason for Medicare entitlement. We've outlined the ways in which an individual becomes entitled to Medicare, when Medicare is the primary payer, and when it is the secondary payer.

Reasons for Medicare Entitlement

There are three ways in which an individual becomes entitled to Medicare:

- Age: Once an individual reaches age 65, that person is entitled to Medicare and eligible to enroll as of the first of the month in which they turn age 65.

- Disability: While this requires approval by the Social Security Administration, individuals who are deemed disabled become entitled to Medicare on the 30th month of disability.

- End Stage Renal Disease (ESRD, a.k.a. kidney failure): The date individuals become entitled to Medicare varies based on treatment situations. For more information, visit the CMS website.

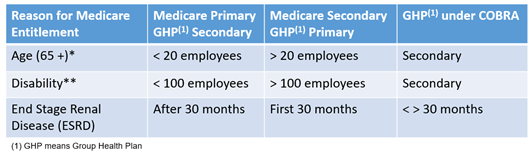

The chart below illustrates when Medicare is the primary payer and the group health plan is the secondary payer, and vice versa. Generally, the group health plan is the primary payer for enrolled employees and their dependents. However, small employers have a special exception. There are two categories of small employers, which are defined by the reason for Medicare entitlement.

Employers with Fewer Than 20 Employees

When the reason for Medicare entitlement is age-related and the employer has fewer than 20 employees for each working day in at least 20 weeks in either the current or the preceding calendar year, Medicare is the primary payer and the group health plan is secondary.

Employers with Fewer Than 100 Employees

When the reason for Medicare entitlement is due to disability and the employer has fewer than 100 employees on at least 50% of its regular business days during the previous calendar year, Medicare is the primary payer and the group health plan is secondary.

End Stage Renal Disease (ESRD)

When the reason for Medicare entitlement is due to ESRD, the group health plan is the primary payer for the first 30 months and Medicare becomes the primary payer thereafter. There is no exception to this rule.

COBRA Coverage

Medicare will become the primary payer when beneficiaries lose their jobs and lose coverage by virtue of current employment status. If a Medicare beneficiary chooses COBRA, Medicare pays primary and the COBRA coverage through the group health plan pays secondary. If the reason for Medicare entitlement is due to ESRD, the ESRD rules above apply under COBRA. As such, electing COBRA can be an expensive endeavor for coverage that is not primary. Be sure to direct Medicare eligible individuals to the Medicare website if they are considering COBRA.

Employer Prohibited Actions

Under the Medicare secondary payer rules, employers cannot offer Medicare entitled participants a financial or any other incentive to opt out of the employer sponsored group health plan and take Medicare instead. The plan must offer current employees or current employees’ spouses age 65 or older the same benefits, under the same conditions and terms available to employees or spouses under age 65.