When Vita was founded in 1979, our mission was simple: provide our clients with a level of knowledge and service unsurpassed in the employee benefits industry. This year, we celebrate 40 years of not only making our mission a reality, but also helping to make the lives of our clients and their employees easier, healthier, and richer through thoughtful and diverse benefits programs.

Today, we help thousands of employers grow their businesses and cultures their own way. With our new brand identity, we hope to inspire continued growth, a more human approach, and a celebration of life.

Growing with You

Our namesake is Latin for “life.” Our new leaf design represents Vita’s growth over time and into the future, as well as how we influence the growth and lives of our clients and their employees.

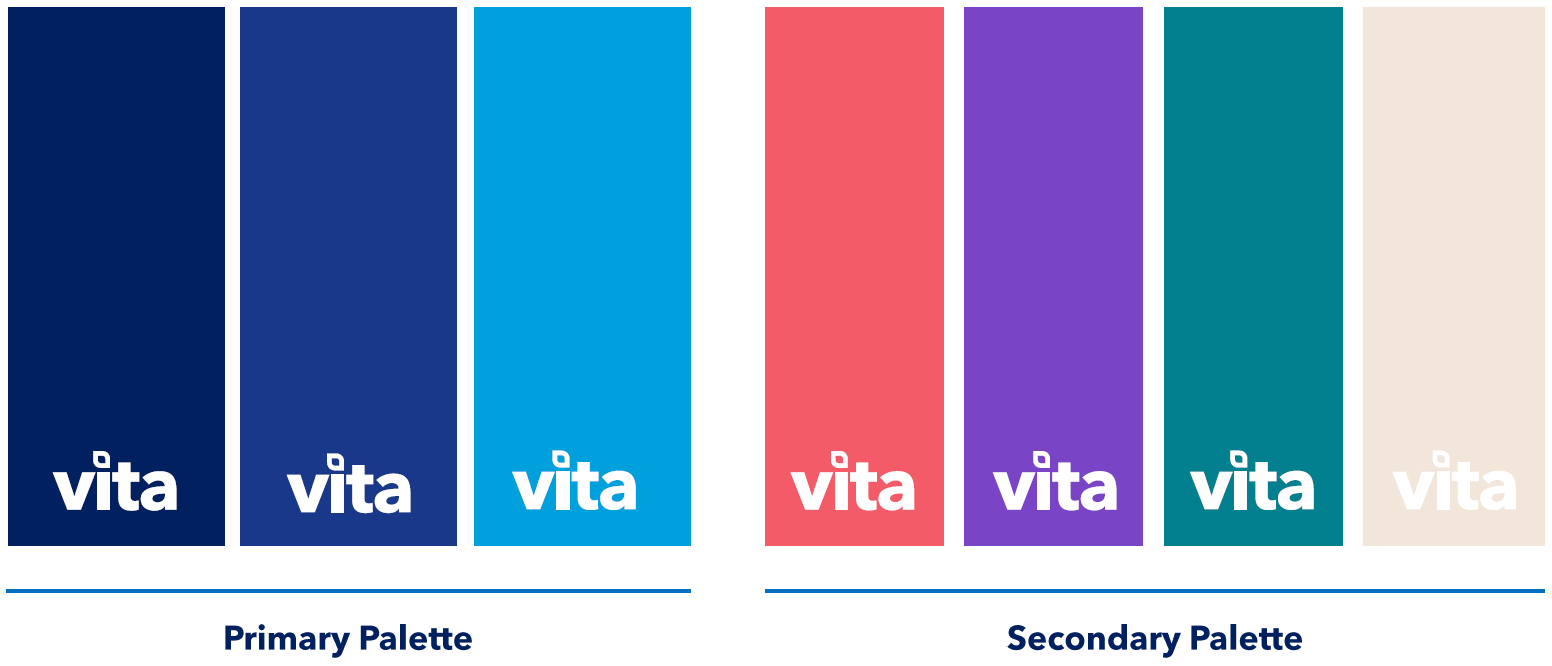

We’ve warmed up our Vita blues with some coral, teal, and tan tones, because who said insurance and finance brands need to feel cold?

Going Forward

Ultimately, the foundation of Vita’s brand is not the logo or colors that are on our business cards and website. Rather, it’s our passion for partnering with you, our clients, to create benefits programs that delight your employees, make work easier for you, and strengthen your culture.

We have many more exciting updates coming soon and we can’t wait to share them with you.